Fox Business | Personal Finances | October 7, 2019

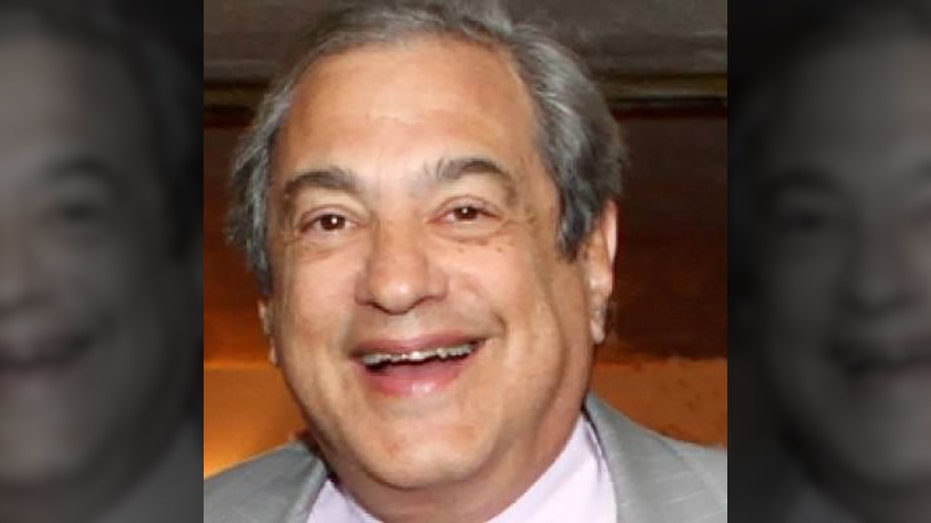

New York is going after hedge fund manager Nelson Obus over taxes it says he owes on a vacation home in the state, but Obus is prepared to continue fighting his $500,000-plus tax bill.

“I’m furious, it leaves a bad taste in my mouth,” Obus told FOX Business. “I don’t need New York … [but] I want to play this out. We don’t cut and run.”

The New York State tax department scored a major legal victory against Obus last month, after a judge ruled he must pay taxes as a “statutory resident” of New York State because of his Northville, New York, home – even though he is domiciled in New Jersey.

Regardless of the amount of time spent at the property, it was determined that the home is a “permanent place of abode.” Since Obus works in New York City, he spends an aggregate of more than 183 days in the state per year.

He owes $526,868 in back-taxes, plus interest and penalties for the 2012 and 2013 tax years. He purchased the house – where he spends no more than three weeks per year – in 2011 for $290,000.

Obus, who is no stranger to the high-tax exodus occurring in the state, called New York’s tax department “opportunistic” and “extremely aggressive,” adding that it doesn’t “reflect well” on the state if it doesn’t create a welcoming environment.

“I can burn the damn thing down and still be okay, but … they don’t have the right to double tax me,” Nelson said.

Glenn Newman, a tax lawyer at Greenberg Traurig who worked with Obus on the case, previously told FOX Business they were going to appeal the decision.

Experts have also told FOX Business that as New York State loses tax revenue from the flight of individuals to lower-tax havens – like Florida – auditors are likely only going to get more aggressive, specifically where wealthy residents are concerned.

As previously reported by FOX Business, most individuals lose their audit cases against the state of New York. The average amount they are forced to cough up to the Empire State is $144,000.

Between 2013 and 2017, New York State collected about $1 billion from residency audits, according to data from audit defense company Monaeo. During the timeframe, an average of about 3,000 non-residents were audited per year.

See original article on Fox Business at https://www.foxbusiness.com/money/hedge-fund-manager-new-york-tax-bill